Navigating the Landscape of American Finance: Understanding the Federal Reserve Bank Map

Related Articles: Navigating the Landscape of American Finance: Understanding the Federal Reserve Bank Map

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape of American Finance: Understanding the Federal Reserve Bank Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of American Finance: Understanding the Federal Reserve Bank Map

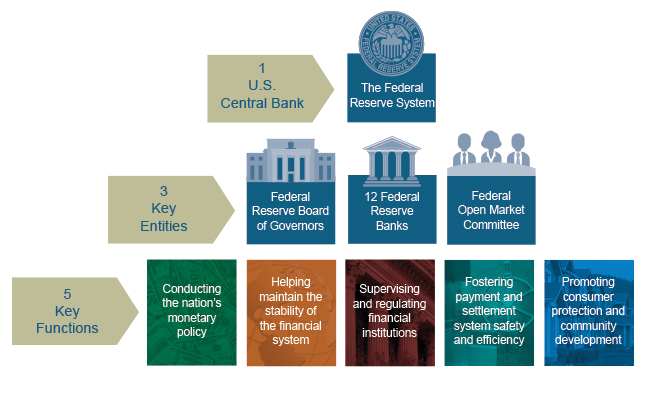

The United States Federal Reserve System, often referred to as the Fed, is the central bank of the nation. Established in 1913, its primary purpose is to maintain a stable and healthy financial system, promoting economic growth and stability. A key element in understanding the Fed’s structure and reach is the Federal Reserve Bank Map, a visual representation of the geographical distribution of its regional branches.

A Network of Regional Banks:

The Federal Reserve System is comprised of 12 regional Federal Reserve Banks, each serving a specific geographic district within the United States. These districts are not merely arbitrary divisions; they reflect the historical and economic realities of the nation. The map visually depicts these districts, each represented by a different color, outlining their boundaries and highlighting the locations of the regional Federal Reserve Banks.

Beyond the Map: Understanding the Regional Structure:

The map provides a foundational understanding of the Fed’s structure, but it’s crucial to delve deeper into the individual roles and responsibilities of each regional bank. Each bank operates independently, with its own board of directors and president. However, they all work together under the guidance of the Board of Governors, the central governing body of the Federal Reserve System.

Key Functions of the Regional Banks:

The regional Federal Reserve Banks perform a variety of critical functions, including:

- Providing financial services to depository institutions: This includes clearing checks, providing loans, and managing the electronic transfer of funds.

- Supervising and regulating financial institutions: Regional banks play a vital role in ensuring the safety and soundness of banks and other financial institutions within their districts.

- Conducting economic research and analysis: They gather and analyze economic data, providing valuable insights into the current state and future outlook of the economy.

- Facilitating payments and settlements: Regional banks provide essential infrastructure for the efficient and secure movement of funds within the financial system.

- Issuing currency: Each regional bank issues currency with its unique identifying number and letter code, which helps trace the origin of the bills.

The Importance of the Regional Structure:

The regional structure of the Federal Reserve System offers several advantages:

- Localized expertise: Each regional bank possesses a deep understanding of the economic conditions and financial landscape within its district, allowing for tailored policies and interventions.

- Decentralized decision-making: The regional structure enables the Fed to respond more effectively to local economic fluctuations and challenges.

- Increased accountability: The presence of regional banks fosters a sense of accountability and transparency, ensuring that the Fed’s actions are responsive to the needs of the communities it serves.

Navigating the Map: A Guide to Understanding the Districts:

- District 1: Boston: Encompasses Maine, Vermont, New Hampshire, Massachusetts, Rhode Island, and Connecticut.

- District 2: New York: Includes New York State and northern New Jersey.

- District 3: Philadelphia: Covers Delaware, Pennsylvania, southern New Jersey, and most of Maryland.

- District 4: Cleveland: Serves Ohio, western Pennsylvania, eastern Kentucky, and northern West Virginia.

- District 5: Richmond: Includes Virginia, North Carolina, South Carolina, Maryland (excluding Baltimore), and the District of Columbia.

- District 6: Atlanta: Covers Florida, Georgia, Alabama, Mississippi, and parts of Louisiana and Tennessee.

- District 7: Chicago: Serves Illinois, Indiana, Wisconsin, Michigan, and parts of Missouri and Iowa.

- District 8: St. Louis: Encompasses Missouri, Arkansas, Tennessee (excluding Memphis), southern Illinois, and parts of Kentucky and Mississippi.

- District 9: Minneapolis: Covers Minnesota, Montana, North Dakota, South Dakota, and parts of Wisconsin and Michigan.

- District 10: Kansas City: Includes Kansas, Nebraska, Oklahoma, Colorado, Wyoming, and parts of Missouri and New Mexico.

- District 11: Dallas: Serves Texas, Louisiana (excluding New Orleans), New Mexico (excluding Albuquerque), and parts of Oklahoma and Arkansas.

- District 12: San Francisco: Covers California, Nevada, Arizona, Utah, Alaska, Hawaii, and parts of Idaho, Oregon, and Washington.

Understanding the Benefits:

The Federal Reserve Bank Map is not merely a static representation of geographical boundaries; it symbolizes the interconnectedness of the American financial system. By understanding the regional structure of the Fed, individuals and businesses can:

- Gain insights into local economic conditions: The map provides a framework for understanding the specific economic challenges and opportunities facing different regions of the country.

- Access relevant financial services: Knowing the location of the regional Federal Reserve Bank allows individuals and businesses to access the services they need, including loans, payments processing, and regulatory guidance.

- Engage in policy discussions: The map serves as a starting point for understanding the regional perspectives that influence the Fed’s monetary policy decisions.

Frequently Asked Questions:

Q: What is the purpose of the Federal Reserve Bank Map?

A: The map visually represents the geographic distribution of the 12 regional Federal Reserve Banks, highlighting their locations and the districts they serve.

Q: Why is the Federal Reserve System organized into regional banks?

A: The regional structure allows for localized expertise, decentralized decision-making, and increased accountability, enabling the Fed to respond effectively to local economic fluctuations and challenges.

Q: What are the key functions of the regional Federal Reserve Banks?

A: Regional banks provide financial services to depository institutions, supervise and regulate financial institutions, conduct economic research and analysis, facilitate payments and settlements, and issue currency.

Q: How do I find the regional Federal Reserve Bank for my area?

A: You can locate the regional bank for your area by using an online map or by searching for "Federal Reserve Bank" followed by your state or city.

Q: Can I visit a regional Federal Reserve Bank?

A: Most regional banks offer tours of their facilities, providing an opportunity to learn more about their operations and the role of the Federal Reserve System.

Tips for Utilizing the Federal Reserve Bank Map:

- Research the regional bank in your area: Understand its specific responsibilities and the economic conditions within its district.

- Explore the economic research and data published by regional banks: Gain insights into local economic trends and forecasts.

- Attend events and workshops hosted by regional banks: Engage with experts and learn about current economic issues and policies.

- Contact the regional bank for assistance: Seek guidance on financial services, regulatory matters, or economic research.

Conclusion:

The Federal Reserve Bank Map is a valuable tool for understanding the structure and reach of the Federal Reserve System. By comprehending the regional organization of the Fed, individuals and businesses can gain valuable insights into local economic conditions, access relevant financial services, and participate in informed discussions about monetary policy. The map serves as a visual reminder of the interconnectedness of the American financial system and the vital role the Federal Reserve plays in maintaining economic stability and growth.

![U.S. Federal Reserve Regions [2000x1272] : MapPorn](https://external-preview.redd.it/PJ55nuIEDC02P_so2xjyuRearBTaNCVXHl43OzshtVQ.png?width=960u0026crop=smartu0026auto=webpu0026s=97699542c9c5aa19343c42998a4b244d02f8e8a9)

:max_bytes(150000):strip_icc()/dotdash_Final_WhatDo_the_Federal_Reserve_Banks_Do_May_2020-01-08af2fa345a440ff9df4c83495ad4328.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of American Finance: Understanding the Federal Reserve Bank Map. We appreciate your attention to our article. See you in our next article!